Well, I got it partly right, but failed to account for the bounce in the afternoon. We broke below 1320 (as I opined we would). The shorter cycles showed more upside than I thought they would.

If you have studied Gann you know he based much of his cycle work on 360, 90 etc (circle segments). He also like 1/8ths of 90. So - 1/8th of 90 is 11.25 (11.2TD cycle) and 1/4 is 22.50 (22TD cycle - which per Gann is actually 22 1/2 days). Considering this - as we approach the bottom I have made minor adjustments to my cycle presentation take that 1/2 day into consideration.

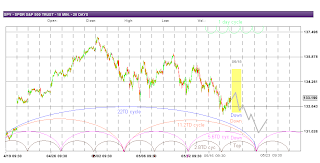

So tomorrow we have the 22.5TD cycle down, the 11.25TD cycle down, the 5.65TD cycle down and the 2.8TD cycle topping. I expect we may have a positive open and then drop. I would not be surprised if we see 1315 or lower for the S&P 500 and under 1310 before we bottom.

Here is the SPY chart:

GL traders. Do your own analysis and don't forget to use stops.

Tidak ada komentar:

Posting Komentar